IoT in banking: benefits, use cases, future

IoT or the Internet of Things has significantly transformed the way we interact with technology. It involves devices, sensors, and connectivity that collect and share information. You may think of IoT as a smart home technology only, but the brilliance of IoT is in its versatility. The same technology can be used for many industries and serve different purposes. IoT opened new possibilities for seamless communication and integration of smart systems in many industries, and banking is one of them. Let’s explore IoT for finance and how the Internet of Things can be used in the fintech sector to improve the banking environment.

What is IoT in banking: definition

IoT is a network of devices that use sensors and connectivity to communicate with each other and the hub. IoT in banking is represented by all devices, tools, and software solutions that banking and finance companies use to improve their workflows and service delivery.

These IoT solutions include

mobile point-of-sale systems

smart ATMs

mobile banking applications

IoT-enabled ATMs

wearable devices

It also helps finance teams easily collect and share IoT-generated data for making better decisions on investments, insurance amounts, assessing risks, and more.

By gathering and transferring data efficiently, IoT helps finance departments save time and money by automating core finance processes. Additionally, IoT’s application in finance extends to improving enterprises’ customer experience in a significant way.

Benefits of IoT in banking

So what benefits does the Internet of Things in fintech offer?

Improved branch banking

Bank branches facilitate face-to-face interactions with customers. With the advancements in technology, a lot of transactional activities have gradually shifted to digital and mobile solutions, leading to a significant decrease in branch traffic.

While offline branches are still far from being dead, the convenience of services has increased dramatically due to the appearance of smart branches. These are special types of bank departments where any client’s request is handled through the connected system. Smart branches are usually installed in hard-to-access or unprofitable spots and there’s no need to hire employees for these branches.

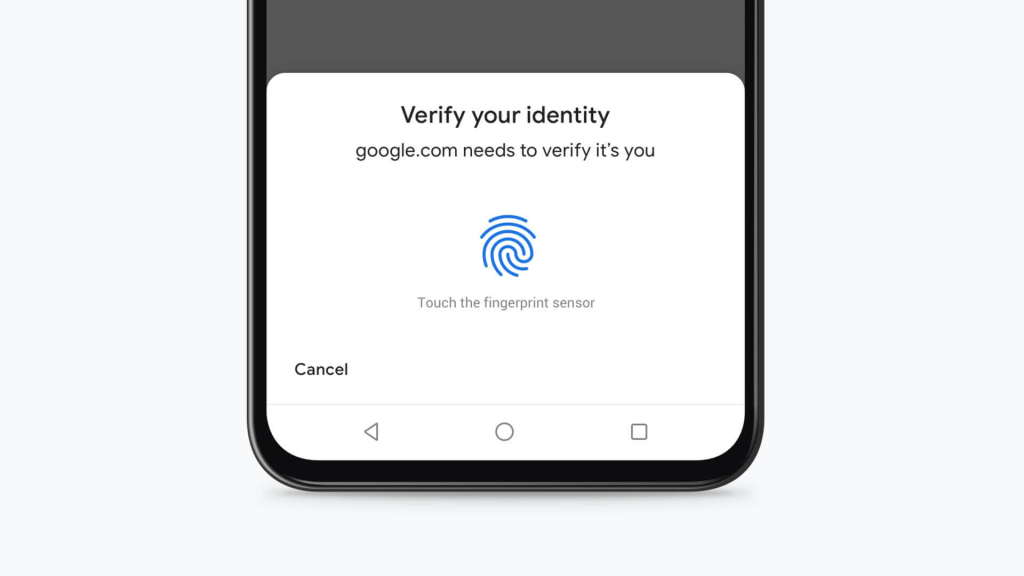

A set of smart branches is connected to a centralized dispatch center through virtual waiting lines. Client requests are processed by a dedicated virtual assistant. With the biometrics technologies in smart branches, a consumer can access his bank account using his fingerprint and make any necessary financial transactions on a remote basis. A user can also speak to a bank operator if necessary via video conference technology.

Better customer experience

The banking industry is putting a lot of emphasis on customer satisfaction and enhancing the digital customer experience. Younger generations prioritize modern and innovative banking services over traditional ones, and they are more likely to switch banks if their expectations are not met.

Millennials and Zoomers are more likely to choose a bank that offers online banking applications or smart branches where they can get service anytime without queues and excessive paperwork. This way, the adoption of IoT technology directly impacts customer engagement and the quality of service provided by banks.

Big data analytics allows financial institutions to gain valuable insights into customers’ habits and offer personalized services based on the data collected. ATM usage patterns, branch visits, and digital interaction statistics can be used to tailor personalized offers and promotions, ultimately enhancing overall customer satisfaction.

Enhanced bank security & fraud detection

Benefits of IoT in banking include enhanced security of the bank branches by utilizing advanced technologies like CCTV cameras, 24/7 monitoring systems, smart alarm systems, and more.

The beauty of IoT is that all these smart devices can be interconnected and remotely managed. Therefore, in case of any breach, the security team can promptly trigger actions like locking up the branch or taking appropriate security measures to prevent banking fraud incidents from escalating.

IoT in fintech can also assist with asset management. With IoT, banks can monitor their equipment, evaluate the assets used in branches, make informed decisions while providing loans, and make risk management more efficient.

Business process automation

IoT in financial services allows the use of software to handle repetitive and time-consuming tasks like data entry, payment processing, account opening, and more. Here are some benefits of the workflow automation.

Higher efficiency: completing more tasks in less time

Better customer service: automatic systems can provide relevant financial assistance and offer support 24/7

Improved compliance: automated systems provide timely and accurate data to ensure that banks abide by regulatory compliance

IoT in banking also allows the automation of financial request handling, transfer of ownership of a specific asset, and other banking operations. Loan processing happens instantly, and banks can monitor the collateral without the need to have them physically present.

Real-time monitoring

Real-time data collection from the banking environment empowers banks to evaluate customers’ needs anywhere and anytime. For instance, banks can project the estimated wait time for customers in line or send notifications to users when their account balances are low.

Another example is real-time transaction monitoring is fraud detection. The system scans the payment details before processing and if there are any discrepancies, the transaction is put on hold. Then the compliance officer investigates the case and if required, checks it out with the customer whether the payment transaction was intentional. This enables banks to provide accurate and reliable services.

Advanced analytics

IoT devices can collect and process huge amounts of data. The collection occurs from users’ smartphones, mobile apps, websites, and other domains where transactions are made and recorded. Advanced analytics help better understand customers’ habits and behavior. This information can be used by banks to segment and retain customers, track their spending patterns, indicate credit risks, etc.

IoT solutions in banking help build a detailed customer profile that includes demographics, service preferences, payment locations, declined bank offers, and other data. Leveraging this data allows banks to offer personalized services and products, and provide relevant financial assistance and budget plans to their customers.

Internet of Things (IoT) in banking use cases

Let’s review some practical examples of IoT in banking.

Smart ATMs

Smart ATMs should be among the key focus points for banks willing to improve their customer experience. Smart ATMs offer a wide range of services — from transferring funds between accounts to cash deposits and clearing checks.

IoT sensors embedded in ATMs can record performance metrics and, in case of downtimes, automatically send notifications to the in-bank systems. Remote access to ATMs from a control center allows avoiding expensive call-outs. This reduces machine downtime since engineers can identify problems instantly and fix technical issues in real time.

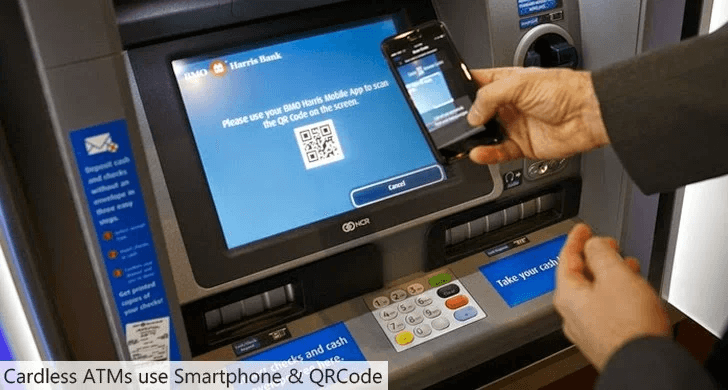

Cardless transactions and services outside traditional banking

Mobile banking applications have made transactions more convenient by syncing with credit and debit cards. This allows users to make contactless payments directly from their phones.

The tap-to-pay features in payment cards and digital wallets are powered by NFC — Near Field Communication technology. This technology allows clients to make payments quickly and easily by simply tapping their phone at the checkout.

Additionally, some ATMs now support cardless transactions, allowing customers to withdraw cash using the mobile banking app instead of a card.

Mobile wallets

Over the recent decades, people have shifted from cash to cards that provide access to digital funds online. With the advent of mobile wallets, customers can now access their finances by simply opening the wallet app and tapping their phones, making payments more accessible than ever before.

Mobile wallets are incredibly convenient and enable customers to carry fewer items, especially in the digital age where most individuals already own a smartphone. This development has been one of the most practical IoT advancements in banking to date. However, customers must ensure the security of their mobile devices to make phone-based payments.

Wearable devices

With biometric authentication apps and wearable devices connected to the Internet, customers can automate and secure payments. Since consumers use their fingerprint or voice instead of a credit card, they don’t need to expose their account details anymore. This significantly reduces the risk of fraudulent transactions.

Other IoT banking use cases include a bank app automatically sending an alert when the client has exceeded their usual monthly spending and offering them personalized saving advice for the next month.

Wearables might become a new powerful channel to do business. IoT devices eliminate the barriers of in-person, paper-based transactions, allowing consumers to speak to their bank assistants from their car, home, or even plane.

Biometric authentication

In recent years, biometric authentication has emerged as a highly effective method to reduce fraud and enhance security in banking. IoT also plays a crucial role in this, using connected devices to collect and analyze biometric data such as fingerprints, face IDs, retinal scans, or voice recognition to verify the user’s identity. This advanced authentication method significantly reduces the risk of unauthorized access to bank accounts and provides an additional layer of security for online banking transactions.

Challenges of IoT in financial services

Let’s address some of the common concerns when it comes to implementing Internet of Things in banking.

Security and vulnerabilities

Everything that is connected to the internet, could become a target for cyberattacks. Unfortunately, IoT systems are not an exception. Since banking is an extremely sensitive field involving customers’ funds, banking technology require enhanced security.

Privacy and data protection

Banks and financial institutions can collect huge amounts of data, including sensitive information. If data breaches occur, customers’ personal information can get into the hands of cybercriminals. The financial sector should take additional measures to protect the data they collect.

Seamless integration

IoT is a complex system involving devices and solutions from numerous manufacturers. Sometimes it becomes difficult to integrate hardware, software, and network seamlessly into a single system. An experienced software architect will help design the system optimally to mitigate the risks.

Software vulnerabilities and users’ ignorance

Mobile banking apps that aren’t maintained regularly may have some vulnerabilities. Hackers can use security breaches to steal money as well as sensitive customer data. Another danger hides in users who don’t properly secure their devices. In this case, even if the software is secure, users can get hacked.

Cost of implementation

The expenses related to IoT technology, such as hardware, software, integration, and security, can be substantial, both for the initial investment and ongoing maintenance. These costs may pose a challenge for smaller banks, preventing them from embracing IoT.

How to implement IoT in the fintech industry

Here’s a quick overview of the IoT development roadmap for a fintech project.

Identifying the bank’s needs and requirements

Conduct a comprehensive analysis of the banks’ requirements and goals for integrating IoT technologies. Questions that can help:

What is our primary goal?

What components do we need (hardware, sensors, firmware, software, network)?

What is the desired outcome that would prove successful IoT implementations?

Development strategy decision

By identifying the primary challenges and opportunities within the bank’s operations, a customized strategy is created. This critical step sets precise goals and expectations for IoT integration, guaranteeing that it aligns with the bank’s long-term digital transformation objectives.

Design

When building an IoT architecture, it’s crucial to carefully choose the right combination of sensors, devices, and connectivity options. During this phase, prototyping plays a vital role in providing a tangible model for stakeholders to assess. This helps in getting early feedback and making necessary adjustments before moving on to full-scale development.

Integration

During this step, IoT devices and systems are integrated with the bank’s existing infrastructure. The process should be managed very carefully to minimize any potential disruption to ongoing operations, and deployment is usually carried out in a phased manner. This step requires rigorous testing to ensure the system’s security and reliability.

Maintenance

After deployment, the focus shifts to maintaining the IoT system’s performance and adaptability. Regular monitoring, troubleshooting, and well-established IoT updates management are necessary to keep the system running efficiently. Additionally, a continuous improvement process is established to refine and enhance the solution over time, based on performance data and user feedback.

What the future holds

We already witnessed a transition from paper money to cards and digital money which happened in just a blink of an eye. The technology and digital solutions are here to stay. As of 2024, there are over 15 billion IoT devices worldwide and the number of active devices is expected to almost double by 2030. This has to be a strong motivation for banks and fintech companies to ride the IoT wave. To stay connected with the new digital reality, learn how to implement the technology and make the banking business future-proof. If you have any questions — we’d be happy to answer them.